There is also a separate tax relief for lifestyle expenses for sport activities. A Subscription having a one-month Term may be terminated anytime without any cancellation fee.

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Find the latest business news on Wall Street jobs and the economy the housing market personal finance and money investments and much more on ABC News.

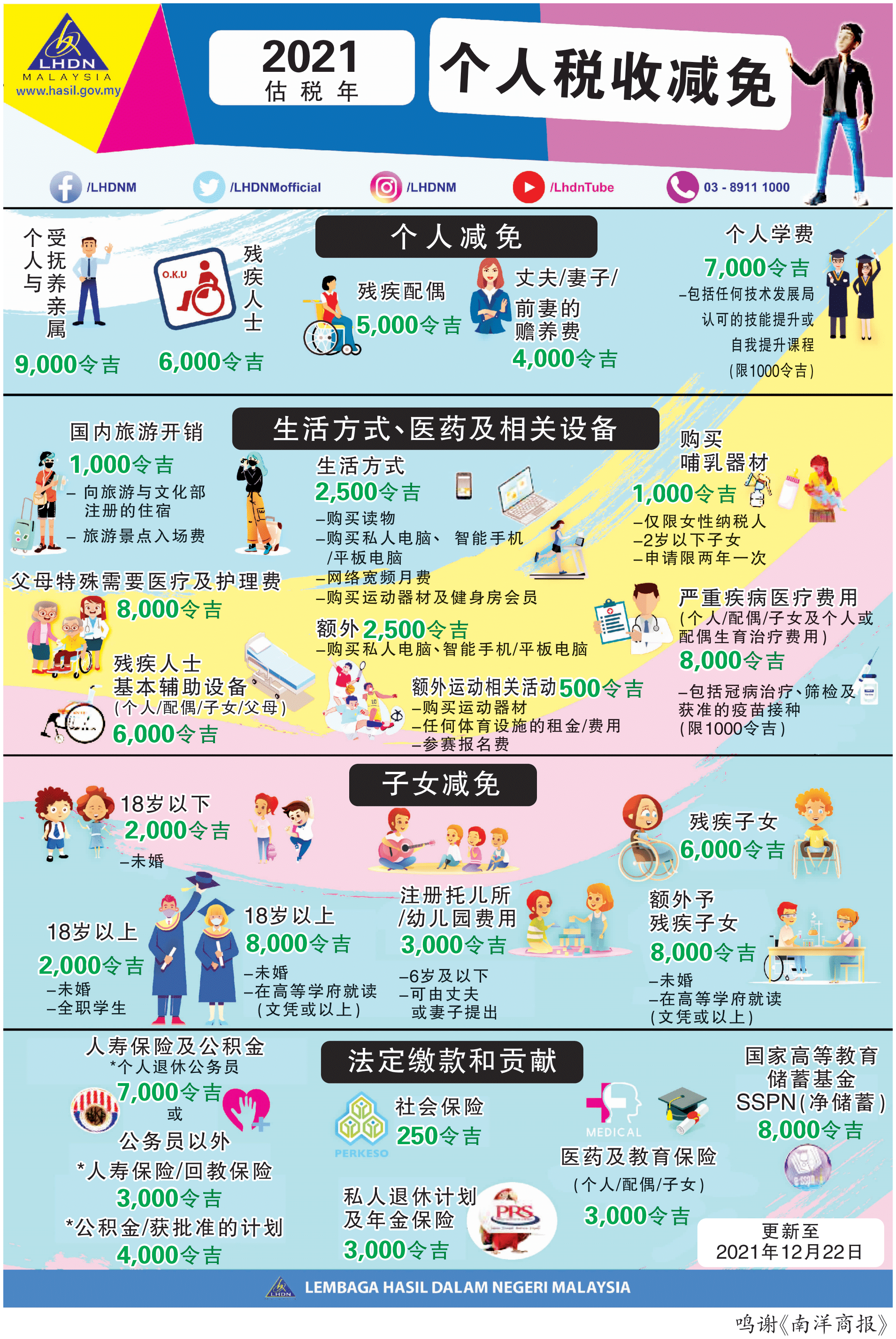

. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. However you must pay all amounts due and owing before the termination is effective. Petronas Malaysias state-owned oil and gas company has announced it is withdrawing from Myanmars offshore Yetagun natural gas project The company through two subsidiaries has held a 40.

Enter the tax relief and you will know your tax amount tax bracket tax rate. For the full list of personal tax reliefs in Malaysia as of the. The previous laptop books stationary and sports equipment tax relief is now grouped under lifestyle tax too.

Internet subscription paid through monthly bill registered under your own name. Your trusted service provider for tax compliance accounting and payroll requirements. 265 percent for FY 2021 unless a lower rate under application of a double tax treaty DTT applies.

Further Education Fees Self. This relief is applicable for Year Assessment 2013 and 2015 only. The Government of Malaysia is fairly reasonable allowing us to get personal tax reliefs from lifestyle expenses such as gadgets and sports equipment to mandatory ones such as education and medical expenses for our parents and ourselves.

Payment of monthly bill for internet subscription. A tax relief limited to RM6000 is available for purchases of special support equipment for yourself your spouse children or parents who are disabled. Below is the list of tax relief items for resident individual for the assessment year 2020.

Youll enjoy a 30-day trial and 720 TALENOX credits that helps pay for your subscription post-trial. Malaysia Personal Income Tax Relief 2021 Malaysian personal tax relief 2021. Buying reading materials a personal computer smartphone or tablet or sports equipment and gym memberships for yourself spouse or child allows you to claim for tax relief.

Payment through the Internet. Equipment for disabled self spouse child or parent. Because this is the most comprehensive and practical guide on income tax relief in Malaysia for the non-tax savvy youyes you.

A tax planner tax calculator that calculate personal income tax in Malaysia. The third option is by far the easiest method which we will go through in this article. Standard CIT rate ie.

Keep up with tax developments to manage risk control costs and seize tax planning opportunities. RM 2500 including child spouse 1 Hybrid computers include Microsoft Surface Windows 8 Hybrid Laptop refer to devices that possess. The government has added a lifestyle tax relief during the 2017 budget which now includes smartphones tablets and monthly internet subscription bills.

You can claim a tax relief of up to RM7000 if you pay for your own further education courses in a recognised higher learning institution in Malaysia. A rate of 0 percent may apply to dividends paid to qualifying EUEEA parent companies as well as to qualifying collective investment vehicles. Ii Subscriptions of more than one-month.

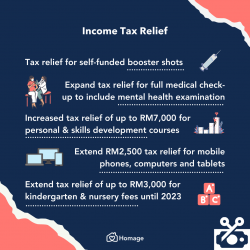

Additional RM2500 tax relief for purchases of personal computers laptops. Theres even a tax relief for alimony payments. You can get up to RM2500 worth of tax relief for lifestyle expenses under this category.

A collection of all publications opinion pieces and reports on. Lifestyle Purchase of personal computer smartphone or tablet for self spouse. The total relief amount was raised by RM2000 from YA 2020s RM6000 in this category.

You may terminate a Subscription at any time during its Term. Payment of monthly bill for internet subscription Under own name 2500 Restricted 10. Every time you fill in the LHDN e-Filing form youll be eligible for an automatic tax relief of RM9000.

Smartphones gym memberships computers and internet subscription are allowed up to RM2500 tax relief. This Malaysia Tax Guide is here to answer all your questions on MTDPCB tax relief. The Center Square Legislation pertaining to establishing education benefits for members of the military and tax relief are part of a number.

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Resident Individual Tax Relief Ya 2021 Wsy Associates

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Income Tax Relief Items For 2020 R Malaysianpf

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

List Of Lhdn S Income Tax Relief For E Filing 2021 Ya 2020 Otosection

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

Govt Extends Tax Relief For Phones Computers Includes Covid 19 Tests For Medical Tax Relief

Covid 19 Vaccine Test Kits A Complete List Of Other 2022 Tax Relief

Malaysia Tax Relief Stimulus Measures For Individuals Kpmg Global

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia